Moving averages are one of the most popular and useful tools in technical analysis. Whether you’re a beginner or an experienced forex trader, understanding how moving averages work can help you recognize trends, filter noise, and make better trading decisions. In this article, you’ll learn what moving averages are, the difference between Simple and Exponential MAs, and how to use them effectively — all in an educational and AdSense-friendly way.

What Is a Moving Average in Forex?

A moving average (MA) is a tool that smooths out price data by calculating the average value of a currency pair over a specific period. Instead of reacting to every price spike or dip, moving averages help traders focus on the bigger picture — the overall trend.

For example, a 10-period moving average on a 1-hour chart will average the last 10 hourly closing prices and plot a smooth line.

Types of Moving Averages: SMA vs EMA

There are many types of moving averages, but the two most common are:

1.

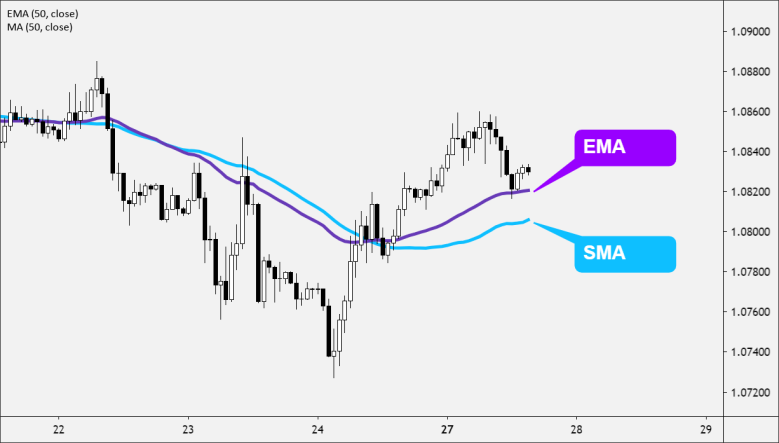

Simple Moving Average (SMA):

• Equal weight given to all data points.

• Slower to respond to price changes.

• Good for identifying stable trends.

2.

Exponential Moving Average (EMA):

• Gives more weight to recent prices.

• Reacts faster to market moves.

• Useful for short-term trading signals.

🔍 Example: A 50 EMA will respond faster to recent changes than a 50 SMA, which smooths things more slowly.

🖥️ How to Add Moving Averages to Your Chart

Almost all trading platforms (like MetaTrader, TradingView, etc.) allow you to add moving averages easily:

1. Open your chart.

2. Choose “Indicators” or “Add MA.”

3. Select SMA or EMA.

4. Set your time period (e.g. 20, 50, 200).

5. Apply and customize colors for better visibility.

📈 How to Use Moving Averages to Spot Trends

Moving averages help identify trend direction and strength. Here’s how:

• Price Above MA = Uptrend

• Price Below MA = Downtrend

• Flat MA = Ranging/Sideways market

You can also use multiple MAs to get clearer signals (e.g., a 50 EMA and a 200 EMA together).

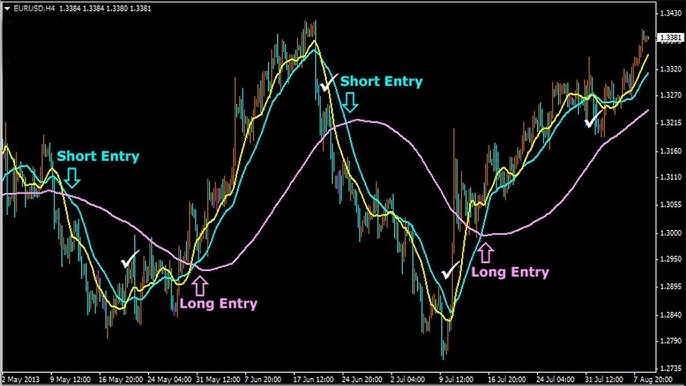

Basic Moving Average Crossover Strategy

A popular strategy involves using two MAs:

• Fast MA (e.g. 50 EMA)

• Slow MA (e.g. 200 EMA)

How it works:

• Buy Signal: When fast MA crosses above slow MA (Golden Cross)

• Sell Signal: When fast MA crosses below slow MA (Death Cross)

Always use crossovers with confirmation and risk management — they’re not guarantees.

Tips for Using Moving Averages Wisely

• Don’t rely on MAs alone — combine with price action or other indicators.

• Choose timeframes that fit your strategy — shorter for scalping, longer for swing trades.

• Avoid choppy markets — MAs work best in trending conditions.

• Backtest your strategy before using it on a live account.

Conclusion

Moving averages are a foundational tool in forex trading. They help you smooth out price action, spot trends, and make more objective decisions. Whether you use SMA for stability or EMA for speed, learning how to apply them correctly can boost your confidence in the market. As always, use any tool as part of a well-rounded strategy.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Trading involves risk, and you should never invest more than you can afford to lose