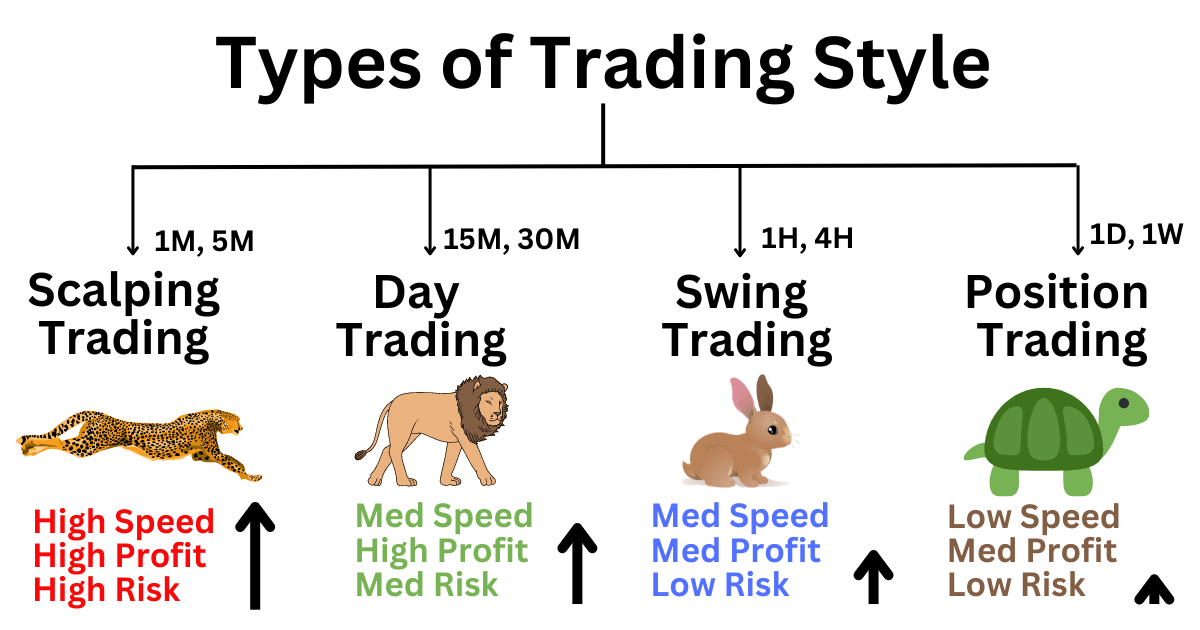

When entering the forex market, one of the first decisions a trader must make is what trading style to use. Trading styles are mainly defined by how long you hold positions, how active you are in the market, and what strategies you apply.

Here are the four main types of trading:

⸻

1. Scalping

Timeframe: Seconds to minutes

Goal: Capture very small price movements (a few pips) many times per day

Scalpers focus on extremely short-term price action. They open and close trades within minutes, sometimes even seconds. The idea is to grab quick profits before the market shifts.

•Pros: Many opportunities, quick results, less exposure to big market moves

•Cons: Very stressful, requires constant focus, spreads/commissions can reduce profits

•Best For: Traders who are quick thinkers, disciplined, and can sit at the screen for long hours

⸻

2. Day Trading

Timeframe: Minutes to hours (all trades closed before the day ends)

Goal: Profit from intraday price movements

Day traders look for opportunities within the same trading day. They avoid overnight risk by closing all positions before the market day ends.

•Pros: No overnight risk, structured daily routine

•Cons: Still requires focus during trading hours, needs time commitment

•Best For: Traders who want daily results but prefer not to hold trades overnight

⸻

3. Swing Trading

Timeframe: A few days to a few weeks

Goal: Catch medium-term market swings

Swing traders hold positions for days or weeks to capture larger moves. They use higher timeframes such as 4-hour or daily charts, often combining technical setups with market fundamentals.

•Pros: Less screen time, larger profits per trade

•Cons: Overnight risk, sudden news can affect trades

•Best For: People with jobs or busy schedules who cannot trade all day

⸻

4. Position Trading (Long-Term)

Timeframe: Weeks to years

Goal: Ride major long-term market trends

Position traders are long-term investors in forex. They rely heavily on fundamental analysis (economic data, interest rates, global trends) and are patient enough to hold positions for months or even years.

•Pros: Potential for huge profits, little need to watch charts daily

•Cons: Requires large stop-losses, patience, and strong psychology

•Best For: Long-term investors who are not interested in short-term fluctuations

⸻

Which Trading Style Is Best?

The “best” trading style depends on your personality, time availability, and goals:

•If you enjoy fast-paced action → Scalping or Day Trading.

•If you want balance between time and profits → Swing Trading.

•If you’re patient and long-term focused → Position Trading.

Since many new traders start with smaller accounts and limited time, swing trading and day trading are often the most practical entry points.

⸻

✅ Disclaimer: This article is for educational purposes only and does not provide financial advice.