The global foreign exchange (forex) market is the largest financial market in the world, with daily trading volumes exceeding $7 trillion. For traders, one of the most important decisions is choosing the right currency pairs. Not all currencies are created equal—some are liquid and stable, while others are volatile and risky. The same principle applies to currency futures, which are widely traded on exchanges such as the Chicago Mercantile Exchange (CME).

In this article, we’ll look at the best currencies to trade in forex and futures, along with what makes them attractive for different types of traders.

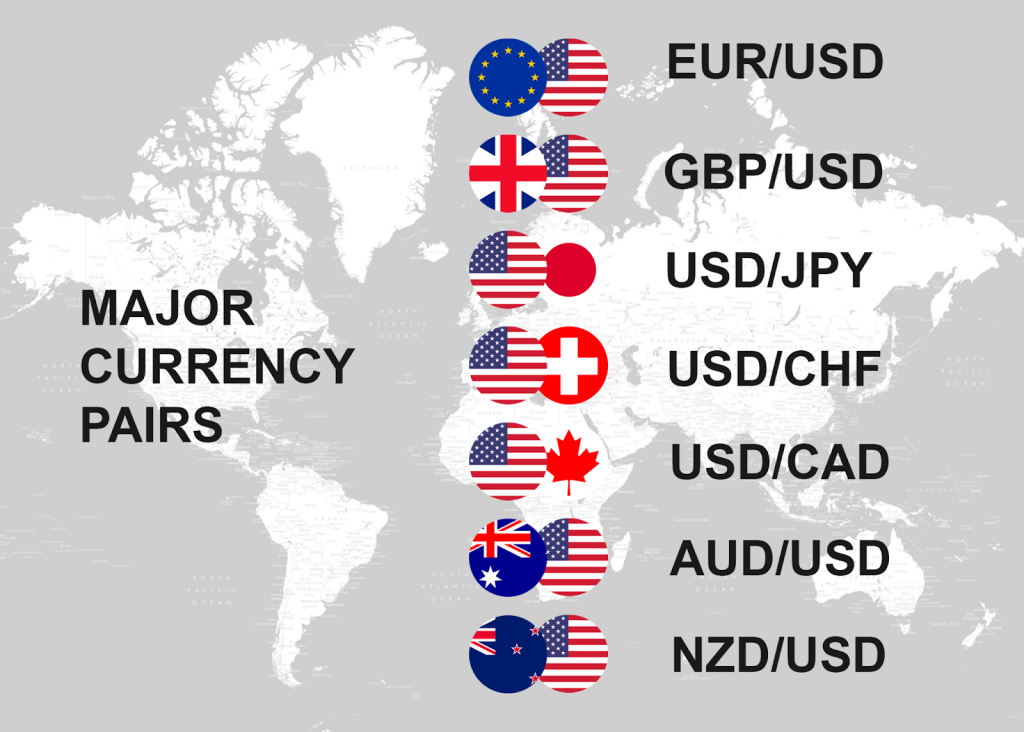

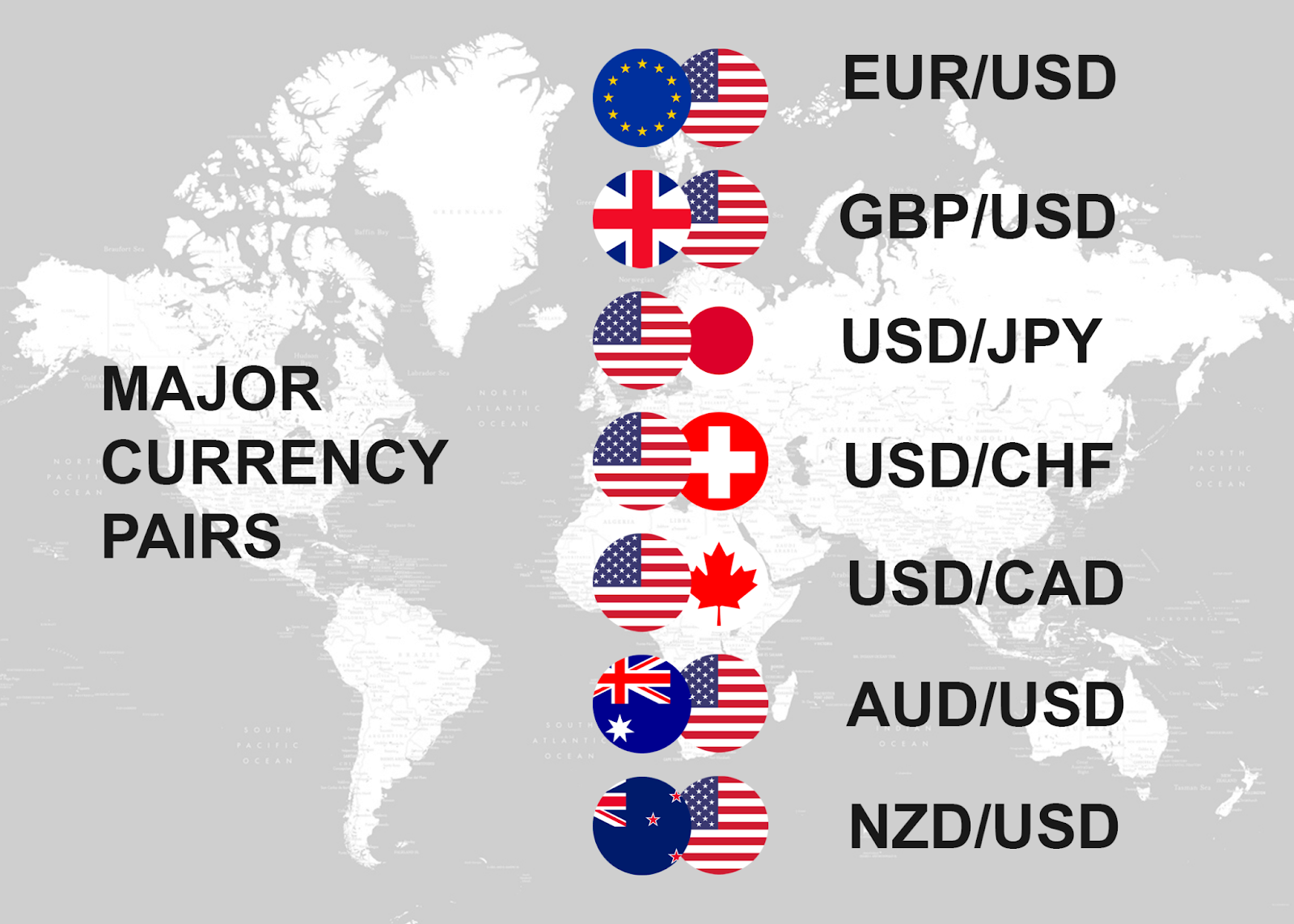

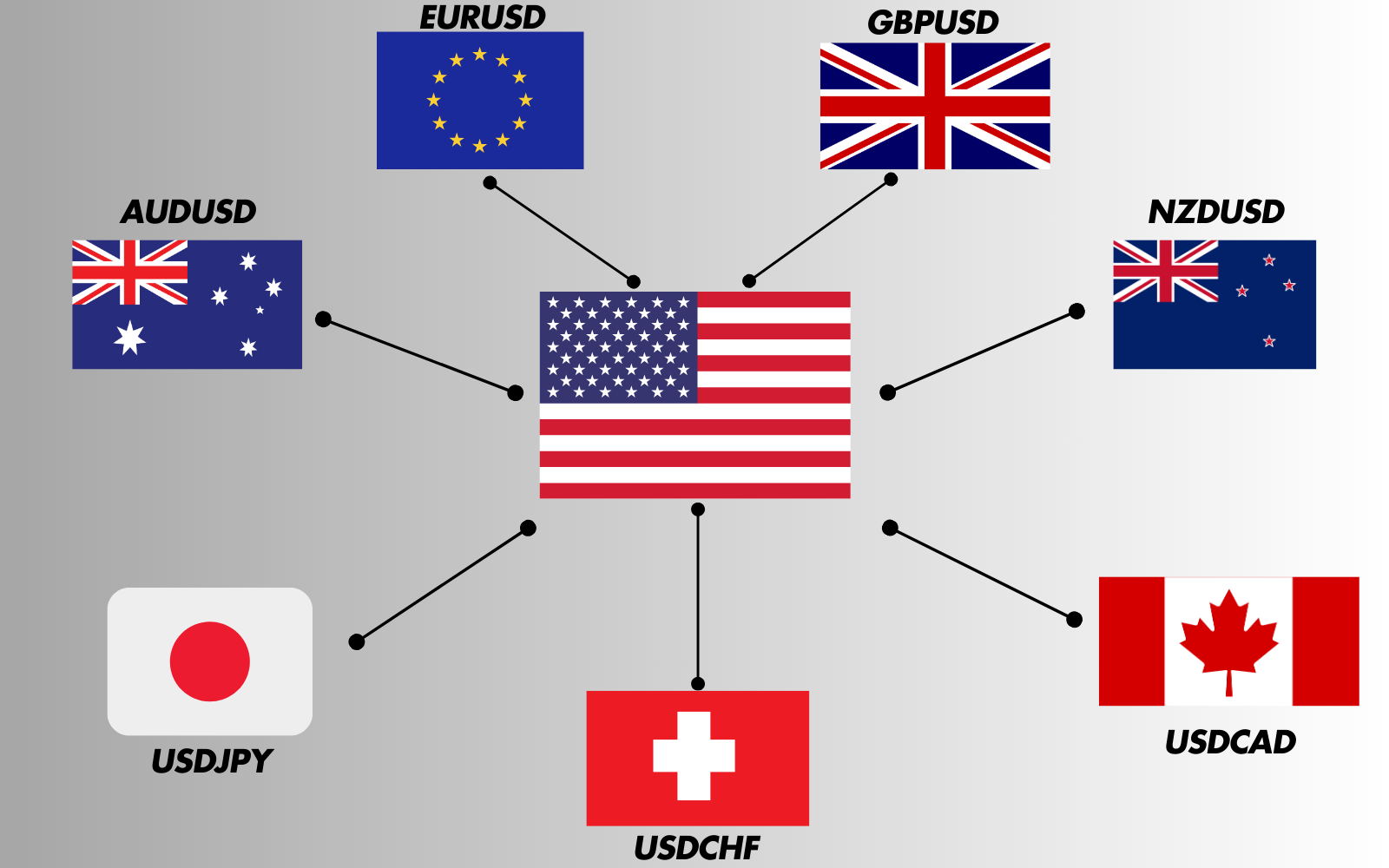

Major Forex Pairs (Most Popular)

The “majors” involve the US Dollar (USD), which dominates global trade and finance. These pairs have high liquidity, low spreads, and smooth price action.

1.EUR/USD (Euro / US Dollar)

•The most traded pair in the world.

•Highly liquid and relatively stable.

•Suitable for beginners and experienced traders alike.

2.GBP/USD (British Pound / US Dollar)

•More volatile than EUR/USD.

•Popular among swing and intraday traders.

3.USD/JPY (US Dollar / Japanese Yen)

•Moves cleanly with global risk sentiment.

•Very liquid and great for trend-followers.

4.USD/CHF (US Dollar / Swiss Franc)

•Known as a “safe-haven” pair.

•Often used during times of uncertainty.

5.AUD/USD (Australian Dollar / US Dollar)

•Strongly influenced by commodity prices like gold and copper.

•Attractive for traders who follow commodity markets.

6.USD/CAD (US Dollar / Canadian Dollar)

•Closely tied to oil prices.

•Provides opportunities when energy markets are trending.

7.NZD/USD (New Zealand Dollar / US Dollar)

•A commodity-driven currency.

•Slightly less liquid but still widely traded.

⸻

Cross Pairs (No USD)

Cross pairs do not include the US Dollar but still offer strong liquidity.

•EUR/GBP – Popular in Europe, useful for trading European economic trends.

•EUR/JPY – A combination of Eurozone fundamentals and Yen safe-haven flows.

•GBP/JPY – Extremely volatile, often called the “Dragon.” Suitable for experienced traders.

⸻

Emerging Market Currencies

These currencies can move sharply, but they come with higher risk due to wide spreads and political/economic uncertainty.

•USD/TRY (Turkish Lira)

•USD/ZAR (South African Rand)

•USD/MXN (Mexican Peso)

These are generally not recommended for beginners.

Currency Futures

If you prefer trading on regulated exchanges, currency futures are an excellent alternative to spot forex. Some of the most traded futures contracts include:

•Euro FX Futures (6E) – Tracks EUR/USD.

•British Pound Futures (6B) – Tracks GBP/USD.

•Japanese Yen Futures (6J) – Tracks USD/JPY.

•Canadian Dollar Futures (6C) – Tracks USD/CAD.

•Australian Dollar Futures (6A) – Tracks AUD/USD.

•Swiss Franc Futures (6S) – Tracks USD/CHF.

These futures are standardized contracts traded on the CME, offering transparency and strong liquidity.

⸻

Which Currencies Are Best for You?

•Beginners: Stick with EUR/USD, USD/JPY, and GBP/USD for cleaner price action.

•Commodity-Focused Traders: AUD/USD, USD/CAD, and NZD/USD are good choices.

•Experienced Traders: Pairs like GBP/JPY or emerging market currencies can provide big moves but come with higher risk.

Final Thoughts

The best currencies to trade depend on your experience, trading style, and risk tolerance. Majors are ideal for most traders, while cross pairs and emerging market currencies offer more volatility. Futures provide a regulated, exchange-traded alternative to spot forex.

Disclaimer

This article is for educational purposes only and does not constitute financial advice. Forex and futures trading involve significant risk and may not be suitable for all investors. Always conduct your own research or consult with a licensed financial advisor before making any trading decisions.